Thomas Piketty, an economist who has for several years been dealing with the relations of distribution in capitalist societies, a field probed by Anthony Atkinson and Emmanuel Saez, has triggered a breach with traditional valuations and social perspectives in both science and public discussion.

According to US-economist Paul Krugman, the “Piketty-Debate” amounts to “a revolution in our understanding of long-term trends in inequality.” (Krugman 2014: 71)

This thesis does not mean that with Piketty all methodological and empirical-theoretical questions of modern distribution structures can be answered, but that “we’ll never talk about wealth and inequality the same way we used to.” (Ibid: 81) This upheaval of the scientific and public discourse is the result of a presentation of both the current condition and of historical knowledge regarding the dynamics of distribution of wealth and incomes since the 18th century. (Piketty 2014: 571)

The core subject of Piketty’s studies is the inequality in the distribution of incomes and wealth. He aims at uncovering the reasons for the socio-economic development which increasingly lend to modern capitalism the characteristics of an oligarchic social structure. More than in any other country the majority of citizens in the US regard themselves as members of the middle class. Unlike in many European countries, where the term “middle class” refers to small businessmen, members of upper-income-groups and self-employed people, in the United States the term “middle class” denotes a “middle layer” of citizens who far outnumber both the poor as well as the rich. Currently the opinion prevails that the dream of American middle class society has for some time now been dissolved into the nightmare of the middle class’s destruction. Unequal distribution of incomes, concentration of wealth and the end of middle class society – those are the topics for which the French economist Thomas Piketty has become a bestselling author in the USA, where for years studies have been presented in abundance on this transformation of the American Dream.

Piketty examines capital accumulation and income distribution in Western Europe and the USA from the beginning of the 19th century up to the Big Crisis of the 21st. In doing so he arrives at the conclusion that currently the unequal distribution of incomes and capital property is approaching values which last were reached at the end of the 19th century. The data regarding the relations of wealth and income in a time span of 100 to 200 years are anything else but uncontroversial. [1] For example, the often used tax data do not include the accumulation of assets in old age pension provision, which play a much larger role for the middle and lower layers of society than for the upper class. Also, the tax reductions for high incomes and assets in a number of countries since 1980 have reduced evasion manoeuvres on behalf of high income earners. This means that tax data might actually overstate the increase of inequalities. [2]

An additional controversy has recently been triggered by a critique according to which Piketty has “adapted”, emphasised and interpreted certain data inadequately. Even after Piketty’s ten-page reply published these days a number of questions remain yet to be answered. All in all, however, it continues to be plausible that in many countries the inequalities regarding income and wealth have since 1980 increased significantly. “The big idea of Capital in the Twenty-First Century is that we haven’t just gone back to nineteenth-century levels of income inequality, we’re also on a path back to patrimonial capitalism, in which the commanding heights of the economy are controlled not by talented individuals but by family dynasties. (Krugman 2014: 72)

Krugman is emphasising and rightly so that our knowledge and evaluation of inequality regarding the distribution of income and wealth are mainly based on surveys. “Yet for all their usefulness, survey data have important limitations. They tend to undercount or miss entirely the income that accrues to the handful of individuals at the very top of the income scale. … Enter Piketty and his colleagues, who have turned to an entirely different source of information: tax records. … Piketty et al. have … found ways to merge tax data with other sources to produce information that crucially complements survey evidence.” (Ibid: 74) [3]

The changes of recent decades lead to a reversal of the “big densification” of the 1950s, when the gap between rich and poor successively decreased. At the beginning of the 21st century, inequality in the USA has reached dimensions unheard of since the world economic crisis of 1929. The USA are increasingly less resembling the middle class democracies of Western Europe than an “oligarchically” structured society, well known in Latin America and post-Soviet Russia, where wealth is concentrated in the hands of a few opposed to an enormous lower class. Studies have shown that more than half of the gains from economic growth in the past two decades were garnered by the richest one percent of the American population, which is the reason why the Occupy Wall Street movement called this economic elite “the One Percent”.

The major thesis of Piketty’s research can be summed up as follows: The USA as well as most other modern capitalist societies are restructuring their social shape towards an oligarchic order, in which a small minority of very powerful and very wealthy people is able to dominate all crucial economic, social and political areas thanks to their financial, economic and political power, which they are stabilising for generations to come.

Piketty compares current statistic data with data from the 19th century and has arrived at a formula which he claims is able to express the central long-term trend of capitalism: r < g. The profit generated from private wealth is higher than the rate of economic growth (g). Without resorting to formulas and numbers, Piketty expresses his findings in the simple words: “Capital is back.” (Cf. Illustration 1)

Illustration 1: Inequality of income in the USA, 1910-2010 (share of the upper 10%)

In the USA between 1910 and 1940, the share of income of the richest ten percent of the population reached 40 to 45% of the national income. In the 1940s a marked … of this income group set in. Between the middle of the 1940s and the end of the 1970s, the share of income of the top ten percent only amounted to the comparatively low level of 35%. In several studies on the relations of distribution in the US, this stage of development is also described as the “big compression”. What is meant by that is that under conditions of a strong technological transformation (“skill-based technological change”) a phase of prosperity was induced for the social middle layers by applying measures of distributive policy. [4] A glimpse at the dynamics of distributive relations in the major capitalist countries during the 20th century shows – albeit with marked differences in the individual countries –, that in the last decades of the century a renewed densification or constriction of social inequality to a small group of wealthy people and high income earners took place. Piketty identifies the following as the crucial factors responsible for the return to patrimonial or oligarchic structures of capitalism:

- At the top of society an existing massive inequality results from a mixture of assets (with corresponding incomes) and salaries / wages.

- In the first decades of the 20th century it was mostly (with a few exemptions in the case of the USA) the inequality with regard to ownership of assets that was responsible for the condition of the class structure.

- Also today the stark inequality in favour of the upper layers of society results from the income generated from capital ownership. Simultaneously the weight of earnings from labour has increased on the side of the upper layers of society, thus contributing to the entire inequality.

Piketty’s explanations regarding the dynamics of social inequality for the entire 20th century remain controversial. This is true especially for his claim that in recent decades the returns for capital assets have increased faster than the entire national income. Piketty does not include in his considerations the dynamics of the growing supply of financial capital, that is, the falling interest rate since the beginning of the 1980s and its effects on price increases for bonds and real estate property. Neither will his references to the exhaustion of the development of productivity and the reverse growth of the population suffice to put an end to the debate about why economic growth is slackening and a possible transition into a phase of secular stagnation is taking place.

The critique Piketty is confronted with of his all too superficial and generalising study of the different structural components of capital accumulation and thus of distribution also concerns the development of salaries and wages. Throughout the 20th century we witnessed an upward development of mass incomes as the consequence of a growing degree of organisational structures and the impact of trade unions. In recent decades there was a decline of the quota of wages and salaries and a splitting up of wages and salaries due to the loss of trade union membership and the adherence to collective agreements. The structural changes as well as the higher weight of the financial sector and the intensified politics of deregulation remain in Piketty’s survey unconsidered for longer periods of time.

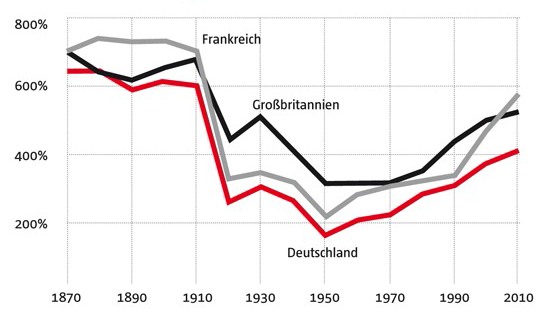

The focus of Piketty’s book is not the incomes but the assets. The share of assets in the hands of the wealthiest is by now much bigger in the USA than in Europe. The richest 10% of Americans own 70% of the overall national wealth, with the richest 1% owning 35%. In Europe the richest 10% own 60% of all assets, with the richest 1% owning 25%. Assets particularly strongly contribute to consolidating the economic and indirectly also the political power relations as they are much less than wages and salaries attributable to the achievement of individual persons but merely bequeathed. (Cf. Illustration 2).

Illustration 2: Value of all privately-owned property in % of the entire national wealth

Capital, i.e. the value of companies, real estate property, bonds and loans, has in recent decades been growing much faster than the entire society’s wealth. That is why the capital owners have left behind the wage and salary earners as well as the middle layers of society. Since the end of the 1970s the phase of the big compression has been petering out, economic growth has begun to slacken, tax reductions have contributed to the rise of capital income and capital profits have exploded, the latter also as a consequence of the expansion of the financial sector. This does not happen merely because the rich generate higher returns from their capital than the small savers but also and even more so because the assets are bequeathed to a decreasing number of children. [5]

Piketty, in his study focuses on the development on the side of capital. But like other researchers in inequality relations it does not escape his notice that the origins of the exacerbation of inequality lie in a mixed relation of capital and labour incomes. What is undisputed is that at the top of society the income generated from capital assets overtakes the incomes from wages and salaries as well as from bonuses. [6]

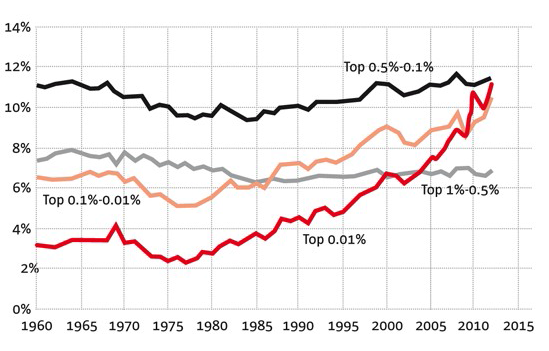

Appropriation by the upper 0.1% of society [7]

There is agreement on the hypothesis that income disparity has since the 1980s massively increased, while at the same time the concentration of wealth has grown only moderately. Yet the claim is unsustainable that the increasing inequality is a mere phenomenon of labour income. It also remains to be explained why in the USA the small group of 0.01% of the highest income earners were able in the last two decades to obtain an extremely high share of the overall wealth (cf. illustration 3).

Illustration 3: Internal differentiation of the top 1%

Piketty emphasises the particular importance of the economic elite (the upper 10%) for the exacerbation of social inequality especially in the USA. Saez and Zucman, who take up and further develop this investigative approach, even boil down the findings to the claim that it is in particular the 0,01% of the upper layer with their top incomes (fixed income claims) who are responsible for the sharp increase of inequality. Thus the question where the causes lie for this shift of distribution in labour income becomes even more urgent.

The reverse side of this ascension of a small group among the economic elite, i.e. their appropriation of a disproportionately high share of the social wealth, is the social decline of the big majority. Of course, it is necessary to further differentiate also among those 90% – in particular, this concerns the dynamics of precarisation of waged and salaried work and the working poor as well as the pressure on the social middle layers. The shifting savings rate of this majority, in fact, a process which even before the big crisis showed itself in a marked decline in savings (negative saving), is strong evidence for the shifts in relations of distribution in the USA.

Since the Great Depression of 1929, the gap between rich and poor has in the USA never been as wide as today. The increase of the share of the upper elite in social wealth corresponds to the decline of the share of the vast majority. The deterioration of their income and property situation finds its expression in the fact that 85% of those US-adults calling themselves middle class share the opinion that it is more difficult today for members of the middle classes to keep up their standards of living than it was ten years ago. 62% of those taking this view hold the Congress responsible, 54% the banks and financial institutions, 38% competition from abroad and 34% the Obama administration. Only 8% say that it is the middle classes themselves who are to be held responsible.

Capitalism of the Financial Markets

Increasing social inequality and for that reason the “disappearance of the middle class” (Krugman) are by no means limited to the USA. Rather, starting out from the USA in the 1970s, the trend towards a society of owners, the rule of asset owners has prevailed, replacing the era of “socially regulated capitalism”. This system, moderated according to national and historical specifics, had reflected an expansion of social rights and social property (security systems with claims) without at the same time suspending capitalist dynamics of accumulation and distribution procedures.

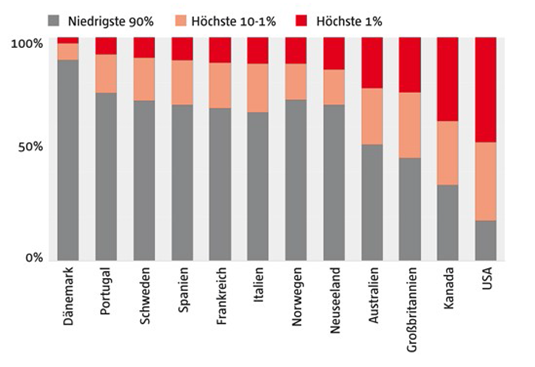

The major characteristic of capital accumulation driven by the financial markets is an increasing social polarisation – which affects both the incomes as well as the assets. This trend has consolidated, as shown by the data published by the OECD for the period of 2007 to 2011 regarding the income situation. “The share of the richest 1% in total pre-tax income has increased in most OECD countries in the past three decades, particularly in some English-speaking countries but also in some Nordic (from low levels) and Southern European countries. Today, they range between 7% in Denmark and the Netherlands up to almost 20% in the United States. This increase is the result of the top 1% capturing a disproportionate share of overall income growth over the past three decades: up to 37% in Canada and even 47% in the United States. This explains why the majority of the population cannot reconcile the aggregate income growth figures with the performance of their incomes. At the same time, tax reforms in almost all OECD countries reduced top personal income tax rates as well as rates of other taxes affecting the highest income earners. The crisis did put a temporary halt to these trends – but it did not undo the previous surge in top incomes. In some countries, top incomes had already largely recovered in 2010.” (OECD 2014, cf. illustration 4)

Illustration 4: Income growths of the top 1% at the cost of the 90% (1975-2007)

The pressurised “middle classes”, “middle layers” or the “social middle” are the focus of the political conflict having ensued from the exacerbation of the class antagonism triggered by financial market capitalism. These classes are defined by their income levels, qualification and social position in their jobs. The “middle” can be characterised by “three central features: a sufficient income, a particular amount of education or professional qualification and a labour market position beyond poorly qualified and physical labour”. (Bertelsmann-Foundation 2012: 48). A closer look at the “middle” described that way shows, however, that quite disparate groups of persons have been lumped together in this group: among others, qualified wage labourers in capitalised industries, employees in the public sector, self-employed as well as non-employed people (retired, pensioners), who are subject to entirely different working and living conditions depending on their respective positions in the social production and reproduction process. [8]

Neither the neoliberal policies of the 1980s and 1990s nor the policies of the “New Middle” have been able to keep their promises to stabilise the situation of the “middle” by providing incentives for property titles or by stripping wages and salaries of social security contributions. The consequences were a growing distance to the political system also within the” middle” and the further erosion of former people’s parties.

This destabilisation of the “middle” and the crisis of its political representation cannot be questioned even by the ruling political and economic elite. At the same time parts of this elite claim – contrary to all development trends based on empirical evidence – that the shrinking middle layers and the polarisation of incomes are mere myths and that the status panic of the “middle” is unfounded.

Simultaneously this process of deterioration of the “middle” is taken into account and a far-reaching change of paradigm implemented which could be described as a parting from the “middle” as the foundations of bourgeois politics. “Yet, the question remains whether the middle layers are able at all to keep together a modern and complex society like ours and how important therefore a wide middle stratum is. After all it is a fact that a stable society of social peace does not rely on a broad middle stratum but can also be brought about by chances at mobility.” (Enste et al 2011: 15)

So far, a convincing political conception to stabilise the social “middle” in times of the big crisis is not discernable with those enlighteners vis-à-vis the “myth of the middle classes”.

Literature

Atkinson, Anthony B./Piketty, Thomas/Saez, Emmanuel (2011), Top Incomes in the Long Run of History, Journal of Economic Literature, 49 (1), pp. 3-71.

Bertelsmannstiftung (2012): Burckhard, Christoph/Grabka, Markus M./Groh-Samberg, Olaf/Lott, Yvonne/Mau, Steffen: Mittelschicht unter Druck, Gütersloh.

Bischoff, Joachim u.a. (1982): Jenseits der Klassen? Gesellschaft und Staat im Spätkapitalismus, Hamburg.

Castel, Robert/Dörre, Klaus (eds.) (2009): Prekariat, Abstieg, Ausgrenzung, Frankfurt a.M.

Deutsche Bundesbank (2013): Vermögen und Finanzen privater Haushalte in Deutschland: Ergebnisse der Bundesbankstudie, Monatsbericht Juni.

Enste, Dominik H./Erdmann, Vera/Kleineberg, Tatjana (2011): Mythen über die Mittelschicht, Roman Herzog Institut, Information Nr. 9.

Kopczuk, Wojciech/Saez, Emmanuel/Song, Jae (2010), Earnings Inequality and Mobility in the United States: Evidence from Social Security Data since 1937, Quarterly Journal of Economics, 125 (1), pp. 91-128.

Krugman, Paul (2011): Infusion für die Wirtschaft statt Aderlass, in: Frankfurter Rundschau 26.9.

Krugman, Paul (2014): Thomas Piketty oder die Vermessung der Ungleichheit, in: Blätter für deutsche und Internationale Politik, Issue 6, 2014.

Leigh, Andrew (2007): How Closely Do Top Income Shares Track Other Measures of Inequality? The Economic Journal.

Müller, Bernhard (2013): Erosion der gesellschaftlichen Mitte. Mythen über die Mittelschicht – Zerklüftung der Lohnarbeit – Prekarisierung & Armut – Abstiegsängste, Hamburg.

Noll, Heinz-Herbert/Weick, Stefan (2011): Schichtzugehörigkeit nicht nur vom Einkommen bestimmt. Analysen zur subjektiven Schichteinstufung in Deutschland, in: Informationsdienst Soziale Indikatoren, Ausgabe 45, Februar; quoted in: Böckler Impuls 6/2011, In den Köpfen hat die Mittelschicht Bestand, pp. 6f.

OECD (2013a): Crisis squeezes income and puts pressure on inequality and poverty. New Results from the OECD Income Distribution Database.

OECD (2013b): Krise steigert Ungleichheit und Armutsrisiko in OECD Ländern – Deutschland und Österreich im Vergleich positiv, press release 15 May, www.oecd.org/berlin/presse/einkommen-verteilung-ungleichheit.htm.

OECD (2014): FOCUS on Top Incomes and Taxation in OECD Countries: Was the crisis a game changer?, May 2014.

Piketty, Thomas (2014): Capital in the 21st Century, Harvard University Press.

Saez, Emmanuel (2013): Striking it Richer: The Evolution of Top Incomes in the United States (updated with 2012 preliminary estimates).

Notes

[1] Chris Giles, a journalist with the Financial Times, had accused Piketty of using shoddy calculations. Piketty concedes that the sources for wealth inequality are much less systematic than those available for income inequality. However, the corrections proposed by the FT are “for the most part relatively minor, and do not affect the long run evolutions and my overall analysis”. At the same time they are themselves based on methodological choices that are “quite debatable”. No question: The data sources can still be optimised, yet the substantive conclusions are not questioned by that. For more than ten years, Piketty has, supported by his colleagues Anthony Atkinson (Oxford) and Emmanuel Saez (Berkeley) analysed historical tax records and feeding his computer with economic data from 20 countries.

[2] As the example of Germany and the CDs on tax evaders illustrates, the practice of tax evasion is still widely spread among corporations and asset owners. In that respect, tax data rather emphasise inequality. If taxation works better in other countries remains to be studied.

[3] The German Federal Bank has compared the overall economic assets balance sheet with a survey among private households. According to the findings, the “coverage of the assets by the private households can be qualified as good. The net assets of the private household sector is, to a degree of 90%, covered by the PHF-study” (German Federal Bank 2013). The data generated in this study from the survey among individual households understate the actual property. These differences can be explained, among others, by the fact “that the extremely rich German households are not represented in the sample. This has effects on the median values in the first place“. (Ibid. p. 28). See also: Joachim Bischoff/Bernhard Müller: Europameister in sozialer Ungleichheit. Vermögensverteilung in Deutschland, in Sozialismus 7-8/2013, pp. 36ff.

[4] Social scientists such as Streeck speak of the “end of democratic capitalism“. From the perspective of distribution policies this formula contains a verdict over 20th century capitalism. Piketty expresses that in the following words: “Make no mistake: the growth of a true ‘patrimonial (or propertied) middle class’ was the principal structural transformation of the distribution of wealth in the developed countries in the twentieth century.” (Piketty 2014: 260)

[5] By their very nature, property-based and capital incomes are “incomes without performance”. Piketty makes it clear that ”it is also significant that the words ‘rent’ and ‘rentier’ took on highly pejorative connotations in the twentieth century. In this book, I use these words in their original descriptive sense, to denote the annual rents produced by a capital asset and the individuals who live on those rents.” (Piketty 2014: 422)

[6] We are confronted by a double delimitation. The values of “capital assets“ are increasing as are the incomes derived from them. Also the differentiations are increasing enormously regarding incomes from labour; the salaries of the well-off (both the upper 10% as well as the uppermost 0.01%) have exploded in recent years. From the point-of-view of distribution policies there are two keys to this problem: regulation of wage and labour incomes as well as a taxation of assets and asset incomes.

[7] Cf.: Emmanuel Saez (UC Berkeley), Gabriel Zucman (LSE and UC Berkeley), The Distribution of

US Wealth, Capital Income and Returns since 1913, March 2014.

[8] Defining the economic anatomy of classes in developed capitalist countries on the basis of the critique of political economy remains an important task the socialist Left will have to tackle in the future albeit its realisation requires adequate resources in terms of time and money (cf. Bischoff et al. 1982).

Original text published in German in Sozialismus Issue 7-8/June 2014

Source: heft_nr_7_8_juli_2014/detail/artikel/der-moderne-kapitalismus-eine-oligarchische-gesellschaft/

Translation into English: Hilde Grammel